Blog » Green Flag Soon to Drop at Daytona

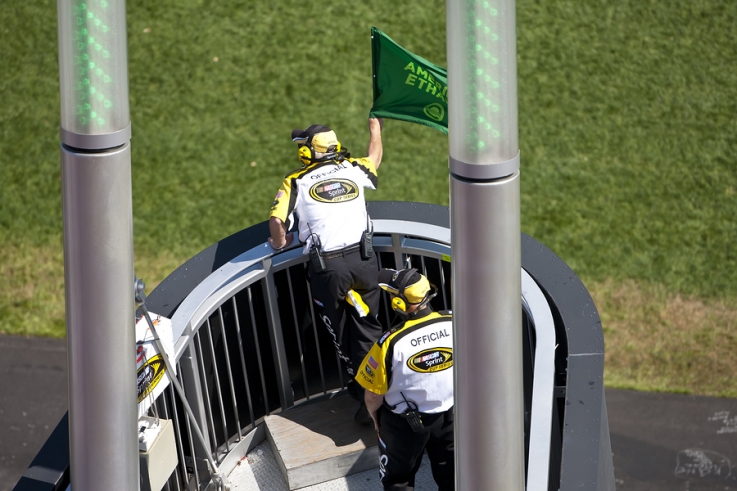

Green Flag Soon to Drop at Daytona

A quick update on projected prices, some very relevant market information - I've been accused of being overly optimistic, perhaps that's my farm roots and true color coming through. However, I hope this update isn't taken or read as doom and gloom. There are some good things happening and coming together for our markets showing recent strength; that said, we face some hurdles which are not limited to the proposed budget and US trade agreements. Let's get to it, the green flag is soon to drop at the Daytona 500...Mr Whisperer, I trust this is timely.

2019 Proposed Budget - President Trump's proposed budget has some significant cuts proposed for agriculture, 2 stories on the proposed budget for 2019: story #1, story #2

2019 Projected prices - markets exhibited strengthening this past week. Just over 60% of the trading days have concluded for this discovery period, with 7 days remaining.

Barley = $3.27

Canola = $0.184

Corn = $3.95

Soybeans = $10.09

Call to arms (of sorts) - I provided the contact information for our elected officials last fall, it is time to do so again, making sure it's at your fingertips. The proposed budget for 2019 and trade agreements need our attention...

Congressional switchboard - 202.224.3121

White House comment line - 202.456.1111

Crop Insurance - National Crop Insurance Services (NCIS) is a member services organization that all crop carriers belong. They've just produced a 1 minute video that might help the less informed in your social circles, be they family or friends...meanwhile, crop insurance provided coverage on a record 311 million acres, 90% of the eligible acres in the US.

Fertilizer - The volatility seen in last year's fertilizer market is expected to be the new norm...expected nitrogen outlook for 2018.

Fraud - It appears that even pro athletes are lured into a scheme for quick, easy money - then 3 square and a room with an obstructed view...take a look at it here

Markets - Prices were stronger for all traded commodities for this past week. Sure is good to see SWW river prices above $5, Lord willing the climb continues. For the week, Chicago was up $.08, KC lead wheat market up $.13, Minneapolis up almost two pennies.

Livestock - Dryness in Australia is having an impact on the beef herd, reportedly causing sale reductions of herd size. This past week produced a record setting sale price for an Angus bull at a production sale in North Dakota, $800k w/ 20% interest retained. Another stir in the livestock industry is a recent package of chicken breasts - the label identified where the farm was located that produced said chicken breasts...how long until beef and pork labeling will need to host the same information is anyone's guess, but cause for concern. Credit the millennials.

Oil - In the good and bad department, OPEC increased world supplies based upon increased US shale production. OPEC went on to say that increased demand would eat up the increase production/supply.

Pulses - India is the world's largest importer and producer of pulses, while Canada is the largest exporter. India's implementation of tariffs to protect their domestic industry after a record setting production of 29 mmt last year, 50% dry peas, 30% lentils and recently garbs were increased from 30% to 40%, have lead to criticism. There are doubts that India's ambitions to be self-sufficient is attainable, given annual consumption at 24 mmt and growing at an annual rate of more than 1 mmt per year. Expectations are that pulse acres will be trimmed globally, perhaps supplanted by beans, canola or DNS.

Trade - New rhetoric on tariff targets and perhaps quota from the US - steel and aluminum industries this time...

PNW Trade - Washington Wheat Growers call TPP a looming disaster in this local report

Weather - As indicated last week, the change in our region's weather is here...more snow and cold expected...it is still winter and two maps that provide proof. Drought conditions remain in the Midwest and Southwest. South America weather is front and center for the traders; Argentina the largest soybean meal exporter, remains dry.

Crop Comments:

Greene County, IL - We removed a fence for a neighbor, they burnt it during a light rain. We dug a hole 15 feet deep to get rid of the stumps and trash, the ground was dry all the way down. We haven't been able to build any dams this fall as the ground is like powder.

Blue Earth County, MN - Valentines Day 40 degrees, but still 6" of snow. Frost 1 to 3 feet deep. Last year riding Harley Davidson and temperatures were in the 60s and 70s, soil had no frost and was dry. Means spring later and cold for us, smaller yield. Basis is narrowed up so markets are a little better, which helps. Cost of repair parts is terrible. I guess companies aren't selling new so stick it to us on the parts to make their profit.

Until next time,

“Advice is what we ask for when we already know the answer but wish we didn’t.”…The Furrow

Curtis Evanenko

McGregor Risk Management Services, LLC

Cell - 509.540.2632

Office - 509.843.2599

Fax - 509.843.2583

Posted in Risk Management; Posted February 21, 2018 by Curtis Evanenko

Comments

No one has commented on this page yet.

Post your comment